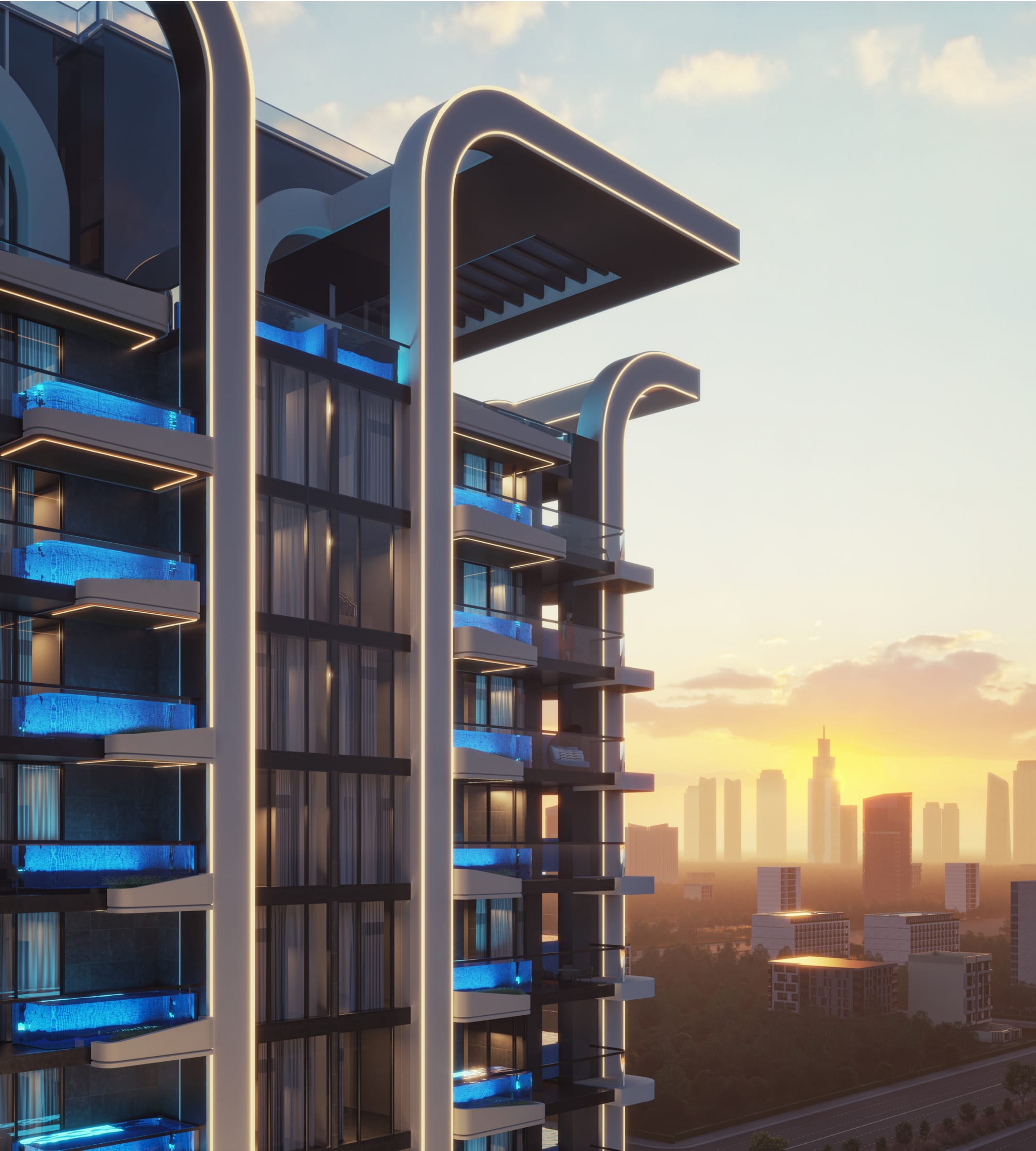

Purchasing property in Dubai is a significant investment, and understanding how to finance your purchase is crucial for a successful transaction. At Foreign Brothers Real Estate Brokers, we have extensive experience guiding clients through the financing process, ensuring they secure the best deals possible. Here’s a comprehensive guide on how to finance your property purchase in Dubai.

Firstly, it’s essential to assess your financial situation and determine your budget. This involves evaluating your income, savings, and any existing debts. Foreign Brothers Real Estate Brokers can help you understand the total cost of purchasing a property, including the down payment, mortgage registration fees, property registration fees, and other related expenses.

Next, you’ll need to secure a mortgage. Dubai offers a variety of mortgage options through both local and international banks. It’s important to compare different mortgage products to find one that suits your financial needs. Key factors to consider include the interest rate, loan-to-value ratio, repayment period, and any associated fees. Foreign Brothers Real Estate Brokers can connect you with reputable financial institutions and mortgage brokers to help you navigate this process.

One of the critical steps in obtaining a mortgage in Dubai is getting pre-approved. Mortgage pre-approval involves a thorough evaluation of your financial status by the lender, which can give you a clear idea of how much you can borrow and what your budget should be. This not only streamlines the property search process but also strengthens your negotiating position with sellers. Our team at Foreign Brothers Real Estate Brokers will assist you in preparing the necessary documentation and facilitate the pre-approval process.